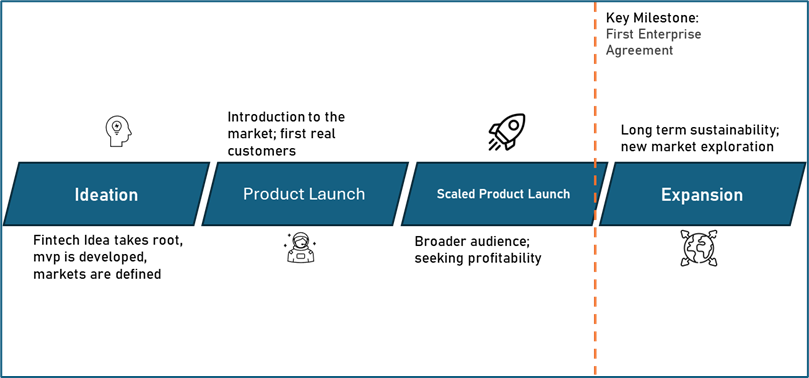

As Fintechs progress through their product lifecycle from Ideation to Expansive Growth, they encounter a myriad of challenges and opportunities, and there are always tradeoffs to be considered for allocation of resources; Cybersecurity is no exception.

In this article, we will explore an approach to taking risk-based decisions around Cybersecurity investments and attempt to help Fintechs take better decisions based on standard Cybersecurity practices as aligned with the Fintech lifecycle, their needs and the client-buyer ecosystem.

Figure 1 Typical Startup Lifecycle: Fintech Perspective – Source: MAKINSIGHTS

1. Ideation:

At the inception stage, when the Fintech idea takes root, cybersecurity is typically not the foremost concern. However, given the characteristics of a Fintech startup — limited funds, a heavily regulated industry, and a yet undefined business model — establishing a practical security mindset early on and identifying a trusted guide to support the overall process is crucial.

Regulations and Market

At this stage, the Fintech can recognize the type of product they will build and the client market they are initially targeting. This is a great starting point to map out initial security requirements by examining the regulatory frameworks the product might be required to implement. Banking services, for example, might require a different set of security considerations than a credit-review application. Additionally, requirements in regions such as EMEA (Europe, the Middle East, and Africa) or LATAM (Latin America) can vary significantly. Privacy regulations are also critical; products that store Personally Identifiable Information (PII) or important financial information usually need to consider allocating slightly more resources earlier in the product lifecycle.

Threat Landscape

Despite limited resources, conducting a thorough assessment of potential cybersecurity threats and vulnerabilities relevant to the Fintech model is essential. This proactive approach not only helps identify immediate risks and sets the stage for future decision-making, but also contributes to the long-term robustness of the product. Leveraging common threat modeling frameworks such as the OWASP Top 10, STRIDE, or the MITRE ATT&CK to determine potential threats, attack vectors, and common security standards in product development is a common leading practice, but even simple working sessions led by knowledgeable personnel is a reasonable start.

Data Privacy and Protection

Data privacy is a critical concern for enterprise and consumer clients. Ensuring that all customer data is handled in accordance with privacy laws and regulations is essential to provide assurances to potential customers and avoid potential fines. Implementing basic data protection measures, including data encryption, access controls, and data anonymization, can help meet these requirements. Considering how the Fintech will want to communication with future clients about how their data is protected should be a key activity to align the Cybersecurity mindset of the Fintech with the commercial reality.

Third-Party Risk Management

As Fintech startups scale, they often integrate with various third-party services, such as payment gateways, credit scoring agencies, and identity verification providers. Each integration introduces potential security risks and management of Suppliers is a core component of the Cybersecurity responsibility of Financial Services organizations. But, let’s be honest, a small Fintech is going to have minimal clout to change the practices of its suppliers initially, so selection of suppliers that have already undergone third-party analysis (e.g. hold a SOC 2 report) is a way to manage the risk.

Ongoing Security Education and Training

Continuous security education and training for employees are crucial. Ensuring that all staff members are aware of the latest security threats, best practices, and compliance requirements can help prevent security incidents. Offering regular training sessions and keeping employees informed about new security policies and procedures is essential. A well-trained workforce is a critical line of defense against cyber threats and while there are many costly resources available, simple training programs such as those offered by CISA (the US government Cybersecurity and Infrastructure Security Agency) are more than adequate at the onset and available globally.

A Plan in Place

By understanding the external requirements of the targeted client market (or investors), gaining knowledge of current trends in cybersecurity, and making prudent decision leveraging the team’s expertise or that of a guide, the Fintech organization is better prepared to plan Cybersecurity features and considerations for its product as launch activities coalesce. Like many considerations facing the Fintech, taking decisions and planning an approach to Cybersecurity upfront can help avoid surprises in later phases of the lifecycle that lead to higher costs and greater adaptation complexities or delays.

2. Product Launch:

The product launch phase is critical period for any startup. At this stage, the initial product offering is introduced to the market, and real-world use begins to have a greater shape the product’s evolution. Ensuring appropriate cybersecurity capabilities are embedded into the product from the outset is essential to protect against threats and ensure customer trust.

Governance, policies and standards

Demonstrating governance structures and the existence of clear Information Security policies and standards is critical when entering into enterprise agreements. Governance involves setting up a framework for accountability and decision-making regarding cybersecurity and include defining roles and responsibilities, establishing a Cybersecurity review/steering committee, and implementing policies that align with industry practices and regulatory requirements. Key areas such as acceptable use, data protection, incident response, access control, and resiliency should be considered. Adhering to recognized standards like ISO/IEC 27001 or NIST-CSF can further bolster your security posture and demonstrate a commitment to maintaining high security standards.

Customer Communication and Trust

Transparency with customers regarding cybersecurity measures and data protection practices is vital. Clear communication about how customer data is protected and what steps the company takes to ensure security can build trust and confidence in the product. In the event of a security incident, timely and transparent communication with affected customers is crucial to maintain trust and comply with regulatory requirements. That also means ensuring Crisis Management activities that have been rehearsed.

Incident Response Plan

Despite best efforts, security incidents may still occur. Having a prudent incident response plan in place ensures that the Fintech can quickly and effectively respond to security breaches. This plan should outline the steps to identify, contain, eradicate, and recover from incidents. Regular rehearsals, testing and updating of the incident response plan helps ensure its effectiveness when needed.

Business Continuity & Disaster Recovery

Conduct business impact assessments to identify critical assets, processes, and dependencies. Develop adequate business continuity and disaster recovery plans to mitigate the impact of disruptive events on business operations and ensure timely recovery. Like incident management, regularly rehearsals, testing and updating of the BC / DR plans helps ensure its effectiveness when needed.

Security Testing

Penetration testing (pen testing) of applications is a critical component of meeting enterprise security standards. Regular pen tests help identify vulnerabilities in the system before malicious actors can exploit them. Conducting thorough pen tests, both internally and by external security experts, ensures that security measures are effective and that potential weaknesses are addressed promptly. Additionally, new services such as Breach and Attack simulation should be considered to replace or compliment legacy pen testing activities as they provide a valuable perspective as to the organization’s ability to respond to a Ransomware attack. In summary, practices should include pen testing of the Fintech app, coupled with Ransomware Resiliency testing for the enterprise.

Cyber Insurance

Investing in cyber insurance might be a requirement to work with a large partner or client and is a prudent step for Fintech startups entering enterprise agreements. Not only does Cyber insurance provide financial protection in the event of a data breach or other cyber incidents, it shows a commitment by management to risk transference. Additionally to obtain the policy it is often a prerequisite that specific security activities have been undertaken, and it can be leveraged by partners and clients as a means to evaluate the maturity of the Fintech. Not having a policy could be an indicator that Information Security is not taken seriously at the Fintech.

3. Scaled Product Launch:

As the Fintech moves from the initial launch to a scaled product launch, the complexity and scope of operations expand significantly. This phase involves reaching a broader audience, increasing transaction volumes, and integrating with additional third-party services. Consequently, cybersecurity measures must also scale to address the growing threat landscape and ensure continuous protection.

Access Controls and Authentication

As user base and transaction volumes grow, implementing robust access controls and authentication mechanisms becomes increasingly critical. Multi-factor authentication (MFA) should be enforced for all users. Role-based access control (RBAC) can ensure that users only have access to the data and systems necessary for their roles, minimizing the risk of insider threats. Taking that one step further, Zero Trust principles should be considered as part of the Identify and Access Management program.

Threat and Vulnerability Management

Continuously monitor and assess threats and vulnerabilities to the organization’s IT infrastructure and applications. Implement proactive measures to detect, prevent, and respond to cybersecurity threats in a timely manner.

Enhanced Security Infrastructure

Scaling a Fintech product requires enhancing the underlying security infrastructure. This includes configuring servers, databases, and network security measures to handle increased traffic, potential threats, and data loads securely. Implementing advanced security technologies such as Endpoint Detection and Response (EDR), intrusion detection systems (IDS), intrusion prevention systems (IPS), and security information and event management (SIEM) solutions can help monitor, detect, and respond to potential threats in real time.

By scaling cybersecurity efforts in tandem with product growth, Fintech startups can protect their expanding operations, maintain regulatory compliance, and foster customer trust. Often the best approach for a Fintech is to outsource these services.

Key milestone: First Enterprise (Consumer Group) Agreement

Milestone: First Enterprise Agreement

Securing the first enterprise agreement is a significant milestone for any Fintech startup. This achievement not only validates the product’s value proposition but also presents new cybersecurity challenges and opportunities. Meeting the rigorous demands of large enterprise clients necessitates a thorough review and potential revamp of your cybersecurity roadmap and governance activities. Ensuring that your Fintech can satisfy regulatory requirements and demonstrate the right Information Security operating principles and capabilities through third-party attestation (e.g. ISO 27000 certification or issuance of a SOC2 report) may be crucial for success once the first enterprise customer is acquired.

Security Audits and Assessments

As mentioned, large enterprise customers will require regular security audits and ex parte assessments. Being prepared for these evaluations is essential. Conducting internal audits and third-party assessments to identify and address security gaps before they become issues is now an expectation. These assessments also provide valuable documentation to demonstrate compliance with varying regulations and confirm the priorities set in the Cybersecurity roadmap.

Secure Software Development Lifecycle (Secure-SDLC)

Formally implementing a Secure Software Development Lifecycle (S-SDLC) ensures that security is considered at every stage of product development and can scale. This includes incorporating security best practices into the design, coding, testing, and deployment phases. Regular code reviews, security testing (such as static and dynamic analysis), and penetration testing are crucial to identify and remediate vulnerabilities as the product scales.

Compliance and Certifications

Achieving industry-standard security certifications can provide a competitive advantage and assure customers of the product’s security. Depending on the Fintech’s focus, relevant certifications might include PCI DSS (Payment Card Industry Data Security Standard) for payment processing solutions or SOC 2 (Service Organization Control 2) for services handling customer data. Compliance with regulations such as GDPR (General Data Protection Regulation) in Europe or CCPA (California Consumer Privacy Act) in the U.S. is also crucial. As the product scales, ensuring continued compliance with these standards and regulations aligned to the market is essential for maintaining trust and avoiding legal penalties.

4. Expansion:

At this point in time, the Fintech startup begins to operate more similarly to an established organization. As it enters the Expansion phase, the company experiences significant growth in market share, revenue, and operational complexity. This phase is characterized by expanding into new markets or introducing additional products and services to meet evolving customer needs. Amidst these developments, adopting a holistic cybersecurity strategy becomes paramount to safeguarding sensitive data, maintaining trust, and ensuring compliance. Key areas of focus include:

Cybersecurity Governance

Revisit the cybersecurity governance structures in place to ensure roles, responsibilities, and decision-making processes related to cybersecurity are clear across the organization. Ensure there is executive leadership oversight and accountability for cybersecurity initiatives and investments.

Risk Management

Implement formal risk management processes to identify, assess, and mitigate cybersecurity risks effectively. Prioritize risk treatment strategies based on the potential impact on business objectives and the likelihood of occurrence and tie accountability back to the enhanced governance framework.

Measurement – (SLAs, KPIs, KRIs)

Service Level Agreements (SLAs) often include specific security guarantees. Eqully important are the KRIs and KPIs that are used to measure the performance of the Cybersecurity program and report back to governance structure. Cyber Risk Quantification may be a consideration for organizations with the maturity to implement this approach. Clearly defining expectations and ensuring the Fintech can achieve the target is vital.

Continuous Improvement

Embrace a culture of continuous improvement in cybersecurity based on risk. Regularly assess and refine policies, procedures, and technologies to adapt to evolving threats and business needs. As Mike Tyson famously said “everyone has a plan until punched in the mouth”; an agile Fintech should be able to pivot based on risks.

Investment in Automation and Emerging Technologies

Our analysis wouldn’t be complete without considering the impact of Artificial Intelligence on the Fintech. Emerging technologies such as AI and LLM are aligned with improving the customer experience as well as with democratizing cybersecurity capabilities. The Fintech should look to behavioral-based cybersecurity controls and attempt to automate routine tasks, improve threat detection and response, and ultimately stay ahead of emerging threats.

Closing Thoughts:

The journey of a Fintech through the lifecycle is never linear and every Fintech has specific characteristics and risks that are unique across people, process, and technology. This guide is intended to provide insights regarding the Fintech journey to success and help leadership take decisions on when/how to invest in Information Risk Management & Cybersecurity amongst competing priorities.

“ MAKINSIGHTS helped me demystify our cybersecurity approach, especially with the important decisions Tandym implemented between Ideation and Launch aligned with the services we required … ”

-Sairam Rangachari (CTO & Co-founder Tandym)

In an increasingly interconnected and digitized world, cybersecurity is not just a compliance requirement but a strategic imperative for Fintechs to succeed and thrive. At MAKINSIGHTS, we are happy to share our experiences working with some of the largest financial institutions globally as well as innovative Fintech organizations that are on the cusp of something new.